Psychology in Investing

What prevents you from building wealth in investing the equity market?

Shyamsunder Adyanthaya

There are two questions that I am asked frequently. The first one: Which is the best investment? We all want the highest returns at any point of time.

There are various investment options—real estate, gold, equity, debt, etc. Over a 30-year period from 1992 to 2020, the Sensex has given a 13% annualised return and gold has given around 11%–quite a good set of returns for both the asset classes. Similarly, a real estate investor might say that he made a lot of money in real estate. Any investment which participates in economic growth and in which you invest with proper understanding and the right approach will make a good investment.

Is it a good time to invest?

This is the second question people ask. We are advised to have a long-term focus. Based on the Sensex giving 13% CAGR returns, if you had invested Rs.1 lakh in 1990, you would have had Rs.40 lakhs in 2020. This is great, but this is where the problem starts. While the long term returns are good. Over the shorter period, there are wide fluctuations.

For example, in shorter periods, Sensex gave no returns in the ten years between 1992 and 2003; but it went up six times in five years between 2003 and 2007. Similarly, gold gave no return for seven years in two periods between 1996 and 2003 and again between 2013 and 2019, but has gone up three times in seven years between 2006 and 2013. Year to year variations are also large. If you look at the annual financial year Sensex returns, it ranges between + 83% to -38%. So how do we handle this? You can’t ignore the short term. The long term is just a collection of short terms that we need to manage.

Markets, by nature, always move up and down more than fair values for two reasons: 1) There is an underlying business cycle. 2) This is magnified by human behavior. E.g., Now there is Covid. The stocks of the businesses that have benefited have gone up much more than the benefits they get out of the impact of the disease; similarly stocks, whose businesses have been hit by the disease, are hit even more than the real impact of Covid.

When emotions have a bull run…

Charles MacKay in 1841 wrote a book titled, “Extraordinary popular delusions and the madness of crowds.” He talks about the various bubbles that happened in the previous centuries and discusses not only economic bubbles but also with respect to beliefs and philosophies. It is still relevant and an interesting read to understand how humans behave irrationally when they are free to act.

Markets are volatile because of human behaviour. The consequence of volatility is that investment returns vary across time cycles. This is difficult for us. Hence an FD is preferred to something that may give a larger return over the longer term but goes up and down.

Money is personal to all of us. It may mean security to one who doesn’t have money. For a person who has money, it may represent status, freedom or power. Since money is personal, investing money becomes a very emotional process. Emotions in turn tend to create reactions (Fig.1) and reactions create wrong decisions and wrong decisions lead to our under- performance.

When biases bearhug…

How do psychological and emotional biases impact our investment returns? To answer this, let us take a ride on equities (Fig 2) from the period April 1997 onwards. This chart shows the return from equities over 18 months.

People constantly look at past returns for making future investment decisions. This is very natural because past is the only thing that we are sure about. Future is always uncertain and we don’t want probabilities and possibilities. Everybody wants certainty. This is a consequence of what is called the Recency bias. What is immediate in our memory and what we see is what decides and drives our actions. In this chart (Fig 2), in 18 months, people have made (-) 25% i.e., negative return.

When people come for the first time, they have often undergone this experience at least once. Their portfolios are heavily loaded towards fixed deposits and other fixed income securities. They are playing safe. They are not interested in investing in equities. People who have invested feel bad. They look at options other than equity.

Herd mentality

Ten months later, the equity markets have gone up by almost 60% from the bottom (Fig 3). People who had invested earlier might have made about 20 to 30% returns. Now it starts getting everybody’s attention. People around you start talking about money they have made and this in turn gives us an affirmation that this is good to get into and the social confirmation bias comes into play.

Once we get this social confirmation, we start looking at it with interest. This leads to a herd mentality as more and more people start getting into this asset. For instance, gold is in the news now. Between 2011 and 2018 April, SIP investors in gold made 0.5% return p.a. and no one was interested. But, since April 2018, with Covid and other related fears, gold has gone up by 40%. Everybody is now interested in gold. Scholarly articles are written about gold even in the mainstream newspapers.

Per se, this is not a bad starting point. This is the only point at which you are motivated to start investing in an asset. I got into the equity market in 1984 during an IPO boom when the markets moved up and lot of IPOs were coming out. How you deal with this will determine whether you become a good investor or not. If you have been early in this, you put in some money cautiously. You are likely to taste initial success as the markets keep going up. You are confident. Everyone seems to be making money. You feel some regret that you were not bolder.

Success and euphoria

Although there are small ups and downs, the market continues to go up and you start feeling thrilled that you have done something right. Invariably, this is also the time that all product sellers start marketing things to you. Mutual funds start coming up with new fund offers (NFO). Stock market comes up with IPOs. News channels beam success stories. You become overconfident and may even start borrowing money or move money from other assets. Greed starts building up. At this stage, a lot of people would have made money over the last two or three years. Momentum traders get in and drive the prices higher. All predictions for the asset only talk of higher levels. Tips start floating around. You find people bragging about the great return they have made.

Although there are small ups and downs, the market continues to go up and you start feeling thrilled that you have done something right.

The Bubble bursts

In the next ten months, the market is practically back to where it was about four years back. The asset was highly overvalued. Investors who look at value, start selling and the momentum traders also start trading in the direction of the markets. You start feeling anxious but you do not believe that you are wrong. You were recently feeling that you have the right formula. You could not have been wrong. If you had got in slightly early in the rise, your portfolio still shows profit. You put in more money to average down. Your loss aversion sets in. (Fig 4)

Over three years, you made no money (Fig 5). Your portfolio is deep in the red. People tell you that that if you can’t invest a lump sum, do a Systematic Investment Plan (SIP). But at this stage, whatever you have done, you carry losses. You came in saying you are in for the long run, you could take the risk. Now you blame the Advisor, Manipulators, Regulators. Everyone but you – people were out there to cheat you. Herd mentality is in action now on the way down.

FEAR, Despondency sets in. Equity at this point possibly has the most future potential but you cannot be convinced. You think, “What’s the big point being in this asset?” You sell and you move to another asset which is doing well recently; probably, an apartment, because now the real estate market is booming, and repeat the same cycle there.

Another year and a half goes by. Market has recovered slightly. If you had not exited earlier, there is some sense of relief as at least your losses are reduced. You want to get out of the market. Where does the market go?

Over the next nine months, market doubles from where it was in the previous period and you recover all your losses (Fig 6). Everything goes on well for the people who have stayed but the majority have lost interest and got out of the market.

In the next two years, the market goes up another 75%. The portfolio which doubled in the previous 1 year has now gone up 3.5 times in 3 years. New investors come in and they get into the same cycle. This is the nature of the market and it will keep happening all the time.

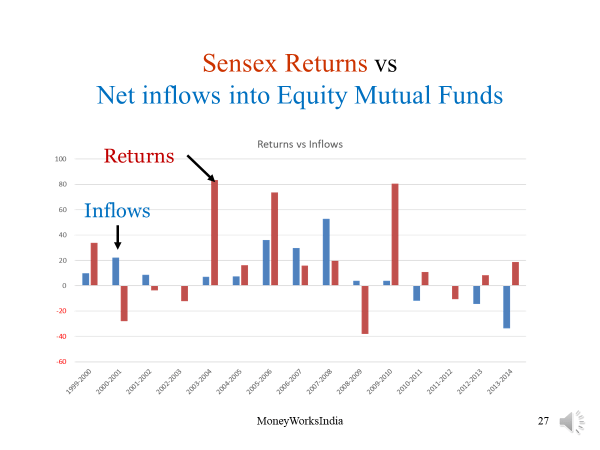

If we look at the net equity inflows and compare it with the Sensex returns, we can see that whenever the returns are positive, the inflows are also positive and when the returns become negative, the inflows start disappearing. Investors who invest in a mutual fund end up making a couple of percentage point less returns than what the mutual fund itself offers and this is a pattern that is seen across the world.

The myth of risk-free return

We have gone through a journey of anxiety, regret, fear, anger, relief, joy, greed and euphoria. We have also seen how some biases like recency/hindsight, social confirmation, loss aversion and overconfidence lead us to make wrong decisions.

Why is this happening? Fundamentally we have a problem in understanding what risk is. Risk is always there in anything that we do. Risk free is practically return free. We have to weigh the possibility of gain versus the risk of loss. Risk comes from not knowing what we are doing. For example, Indian roads are one of the most dangerous places. In a year, nearly 150,000 deaths are reported, yet we don’t stop going out in the road. We learn how to manage the risk.

The risk perception itself is not constant and it depends on our recent experience—success or failure. An investment advisor or a mutual fund distributor is supposed to assess the risk-taking capability of an investor when they come in. When markets are rising, investors say that they are prepared to invest for the long term, when markets fall, they want to exit. Suddenly, their risk perception changes.

Gambling, speculation and investment

The distinction between these three is confusing to many. Gambling is going behind the possibility of gain, ignoring the risk of loss completely. For example, if you bet on one horse out of 10 in a race, without knowing anything about the horse, you would be gambling. Somebody has given you a tip that a particular horse is likely to win and you put your money. If you win, you win and if you lose, you lose your money.

Speculation is about taking risks in the hope of gain, based on conjecture. In the same example, let us say you are not just depending on a tip from somebody; you look at how the horses have been faring in different races, you’ve seen the pedigree of the horse, the conditions in which the horse runs, the race track, the weather and so on. You look at two or three horses which might do well and bet on one out of three horses. Even here, the chances are that you will lose but you keep doing it and might make some money sometime. With investment, you can’t take a blind call. You have to ensure that your capital is safe and that you’re going to get adequate returns with appropriate risk. This involves effort. People think they can get into the market without any effort.

Effort pays dividends

Often when people come to me for investments, I find they have 50 to 60 stocks, and they don’t know why they have bought it. Half of them are not even traded today. They have just mistaken speculation and gambling for investment. They have not done any work on any of these other factors.

To me, Effort is a combination of three things—Time, Knowledge and Aptitude. You should have time on hand. If you’re busy with your career or anything else, then it is better that you stay out of direct investing. If you have time on hand, you could develop knowledge and understanding. You can possibly Google and get many reports on any stock today. But understanding is making sense of that information.

Knowledge and understanding has to be complemented with aptitude and emotional discipline. For instance: Just because you have time and follow cricket does not mean that you have the aptitude to play competitive cricket. You definitely need emotional discipline. A good cricketer might have practiced well, but on the day of the match, if he hits a loose shot and gets out, his career will not last long. It is similar with stocks. If you go and buy a stock that drains all your money, then you will never make a success of your investing.

So you need to tailor your investments to the effort that you are ready to put in. Luckily, in equities, for different levels of effort that you are ready to put in, different products are available. Eg. People who want to do derivative trading, must be willing to put in a lot of effort. The impact of your trades with debits and credits to your bank account on a day to basis, require high level of emotional control.

All trading is effectively a zero-sum game for all the participants put together. For every buyer there is a seller and vice versa. For someone to make money in trading someone loses money. A majority of the small traders loses money. A few players make money. Every time you trade, you have to get both the buy side and the sell side right. Buying stocks on trading strategies require you to continuously follow the markets on a day to day basis, do analysis and research them deeply. It involves frictional costs like brokerage, taxes and also frequent emotional triggering as you watch your stocks. Remember brokers do not make money when you buy and hold. So you will be constantly badgered with information on prospects, strategies etc.

What is important?

If you look at the hierarchy of returns (Fig 8) that you make in the market, it is essentially the investor behavior which makes the largest amount of difference. The second base is the asset allocation. Fees and transaction cost, timing and taxes come in the next order of importance. Most of the investors focus on the top four. What really matters is the bottom two of the pyramid.

So what can be done?

- Invest within your expertise, do research; buy quality stocks. Be confident in your investments, but don’t fall into the confirmation bias trap, where investors only give importance to facts that support their view. It has been noticed that people spend less time on buying stocks than they would, on buying a household appliance. They would probably buy other assets like a house or a property with much more thought and research. Base your investments on strong business fundamentals. Set guidelines, maintain a consistent framework and find investments that fit within it.

- Keep track of your thoughts, reasoning and feelings. Why did you buy the asset? When you want to make a change, remind yourself why you own the security. Understand the root cause for wanting to take action. If all the primary reasons for your investment are still valid, there may not be a reason to sell.

- Don’t try to predict the future. None of us knew we would be in this Covid situation one year back.

- Focus on the long term and believe in the power of compounding.

- Avoid impulsive decisions. Give yourself a cooling-off period. Don’t rush to buy a stock just because you can trade easily with a mobile phone and that you know some online trading tools. Think over for a couple of days and then decide.

- Diversify but don’t over diversify. Diversification helps in the psychological aspect because you don’t get affected much by one asset going up and down but when you over diversify, there is much more work to be done.

- Be cautious about following experts. Everybody who comes with a suit and tie or tells you something on TV is not an expert. If they are not there to take responsibility for the consequences of the decision, you are the only expert. You are the one who is supposed to take the required amount of care.

- Keep your expenses – fees, brokerage, taxes to a minimum.

- Emergency situations always crop up; so have emergency funds available in a liquid form.

- Ensure that you have adequate health and life insurance cover.

- Build a well thought out plan, considering your income, needs, time horizon and risk capability.

- Don’t get carried away by what everyone else is doing.

- Have emotional control. Have discipline to implement the plan.

- Review your current asset allocation. My view is that any money that you require for the next three years should not be put into anything that is ill-liquid such as property or into any investment which is volatile in its price and where you may have a problem in disposing of.

- Based on the surplus funds which are beyond three years reach, determine a target asset allocation.

- Automate your process. Do a systematic investment plan, systematic withdrawal plan and periodic rebalancing, say once in six months or once in a year.

Luck is your blue chip

Remember at the end of it all, time and circumstances play a great role in life. Sometimes you may not get your investments right for a long time but suddenly all the returns that were missing may come into your portfolio. Luck is important in investing. The only point is that you need to put yourself in its way. Do not assume that without doing anything or putting in enough effort, you will get lucky.

Tailpiece: In investing, patience is a virtue.

I suggest you should read the beautiful blog written by Morgan Housel, titled, “The Psychology of Money.” (colloborativefund.com/blog) dated June 1, 2018. He is a very lucid writer. Books written by Daniel Kahneman & Amos Tversky and Richard Thaler will also give you good insights into this subject.